FinFlow

2025

Improved retention with an actionable dashboard for businesses

Problem area

Small teams, big data chaos

Small businesses were drowning in data scattered across tools and spreadsheets. Without clear insights, they made slow and reactive decisions that led to costs and misses opportunities. For us, it led to support to tickets, low adoption, and clients losing trust in the product.

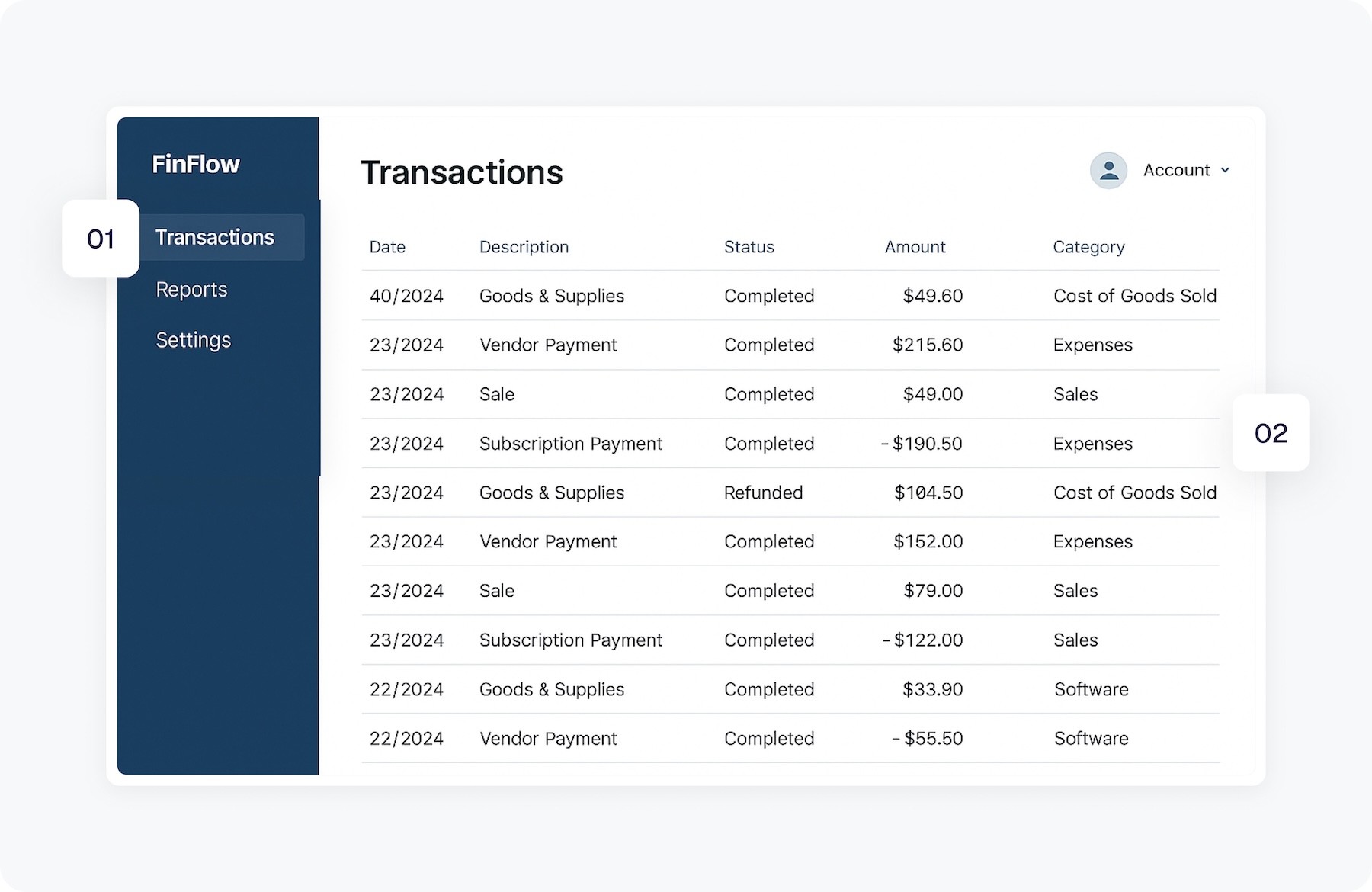

Product before redesign

Design goals

What I aimed to achieve

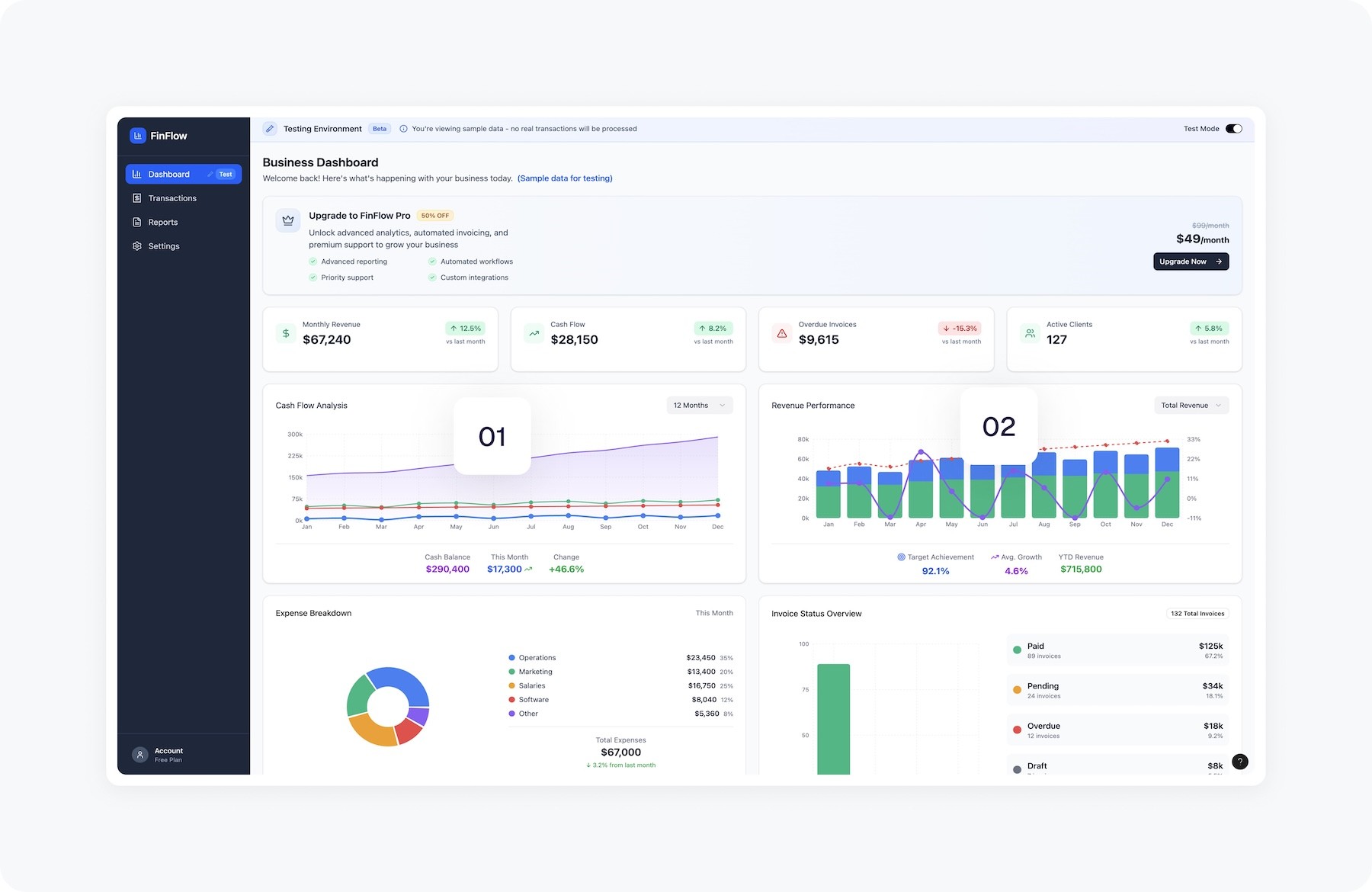

Design decision 01

Defining KPIs that actually matter

Early interviews showed small business owners care about staying profitable, not vanity metrics. I focused the dashboard on cash flow, overdue invoices and growth. It meant trading depth for clarity, but it helped surface quicker insights that could drive better decisions and improve retention.

Top KPIs selected

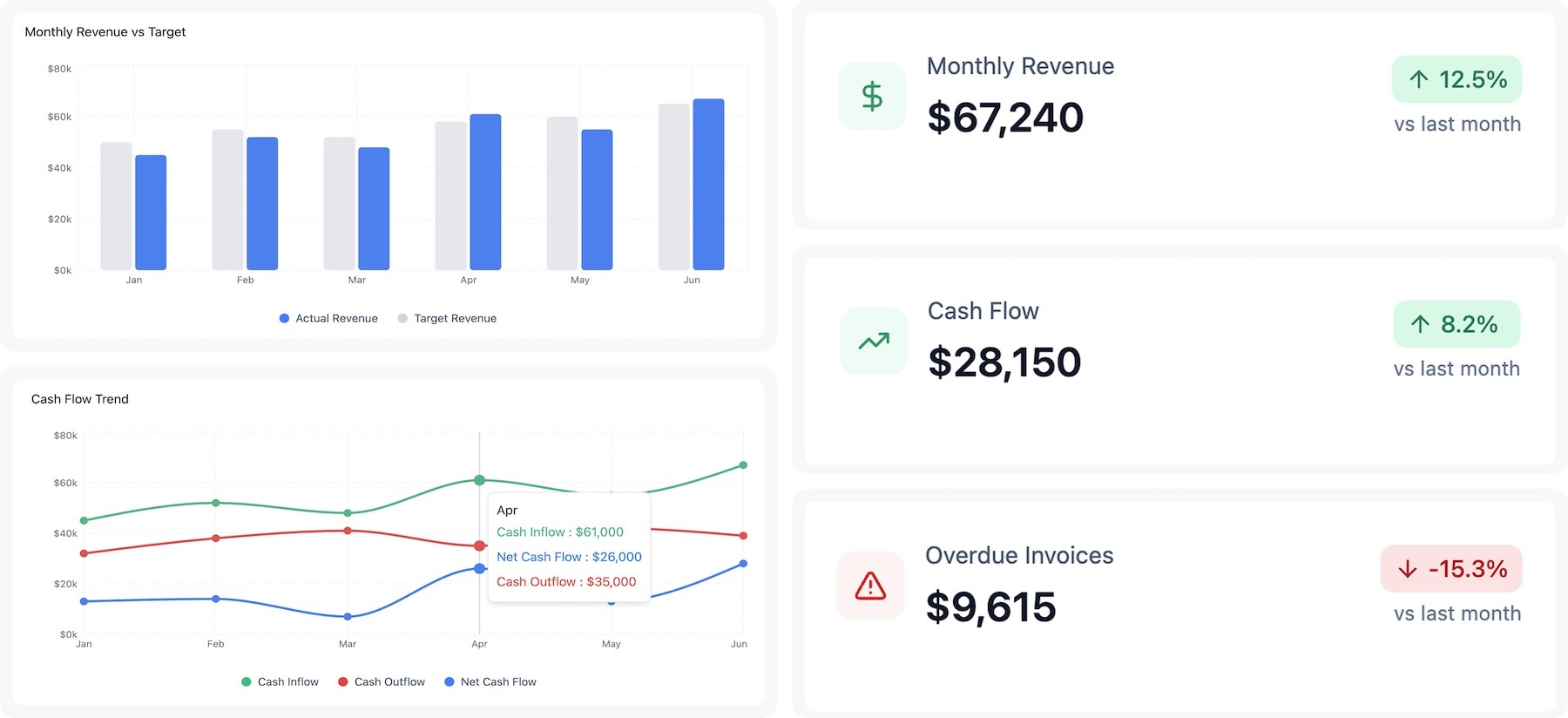

Design decision 02

Building trust through a testing mode

Many users dropped off the platform before connecting their data. Instead of forcing onboarding, I introduced a sandbox mode so they could explore the product right away. It lowered the barrier to entry and helped them understand the value before committing.

Design decision 03

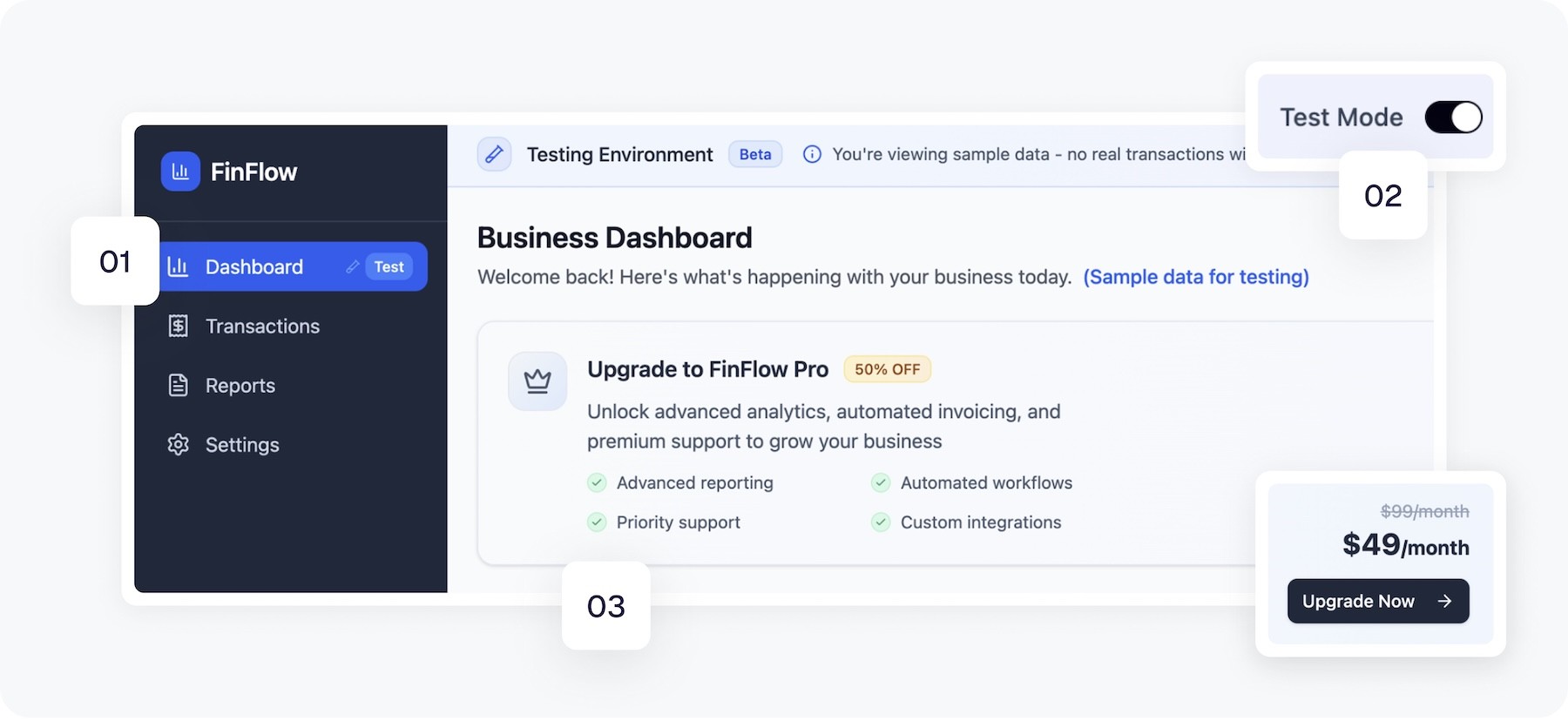

Choosing clarity over complexity in visualisation

I explored two directions: a chart-rich layout and a minimalist one. I went for simplicity because financial data needs precision and quick scanning. The clean layout made key insights easier to understand and improved trust in the tool, especially important at a time when customers were resigning and product retention was decreasing.

Version 01: What I learned testing with business owners: charts were too complex

Retrospective